Norfolk - Harbors Edge

Manager

Steven Cuddy

Lobby Hours

Mon-Fri 9AM-4PM

What Our Members Say

I truly felt like I was part of a family. I wasn't rushed and they made sure that I understood all that was available for me.

- Naomi, a TowneBank Member

*Normal credit approval criteria applies.

^Only deposit products are FDIC insured.

NMLS# 512138

FAQs

-

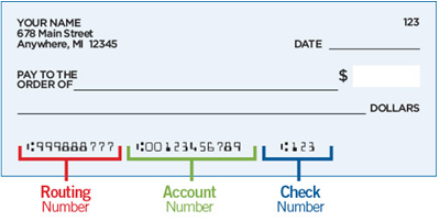

TowneBank's routing number is 051408949.

The routing number is also called an ABA number or routing transit number. You can find it in the lower left-hand corner of your checks.

Financial institutions use routing numbers in order to send and receive money from other banks or credit unions. Routing numbers are essential in a lot of transactions that TowneBank provides like Bill Pay, loan pay, and direct deposits.

Financial institutions use routing numbers in order to send and receive money from other banks or credit unions. Routing numbers are essential in a lot of transactions that TowneBank provides like Bill Pay, loan pay, and direct deposits.

Simplify your Life With Online Banking!

With Towne-Personal Online Banking you can access your accounts, pay bills, make loan payments or even manage your finances through your desktop or mobile devices. Towne Personal features:

- Free Bill Pay

- Free money tracking tools with Money Management

- View balances, pending and past transactions

-

Please contact your hometown banker at your nearest location to learn about current CD rates or special offers in your area.

Discover TowneBank Certificates of Deposit

CDs are a great way to start building your savings. Whether you're saving for education, a new home or retirement, our CDs offer a variety of choices. -

All fees and rates are subject to change. Refer to our Schedule of Fees for a current listing of fees and contact your local banker to learn about current rates and special offers.

Overdraft protection links your checking account to one of your other TowneBank deposit accounts. In the event of an overdraft, available funds will automatically be transferred from the linked account to the covered account. Overdraft protection transfer fees apply. There is no cost to link accounts, and you will only incur a fee if you use the protection. See our Schedule of Fees for more information!

Learn more and talk to your local banker to get started today!

Not a member?

TowneBank strives to be a relationship and friendship driven local bank focused on basic human values that will serve to create a warm sense of belonging and financial well-being among our family of members. Joining is simple! To open an account with TowneBank visit your nearest location or feel free to give us a call and set up an appointment. -

Here is a general overview of the steps you should take if your identity has been stolen:

- Contact one of the major credit bureaus (Equifax, Experian, or TransUnion) and request a fraud alert on your file. The fraud alert will prevent further accounts from being opened in your name for 90 days. If you notify one of the credit bureaus, they should notify the other two.

- Order a copy of your credit reports. Once you've placed a fraud alert, you're entitled to a free copy from each bureau. Then you can review your credit reports to see exactly how you were affected by the identity theft.

- The FTC recommends that you file an identity theft report with them. The report can be used to help you move forward with the process including filing a police report.

- You can start to address the fraudulent items on your credit report. These might be accounts opened without your knowledge or credit used without your permission. You will need to notify both the credit bureaus of the fraudulent items as well as the creditors involved. You should work with them to block the fraudulent items from appearing on your credit reports in the future and to resolve outstanding debts.

Keep tabs on your debit activity with Business and Personal Online Banking! Login to view your transactions now. If it's your first time using Online Banking Enroll Today!

You may also want to ensure that we have your most recent contact information on file as we will use that information to verify your identity. Once you have opened a new account, visit our online enrollment form and fill in all of the fields. If the information you provide matches what we have on record you should receive a notification within one business day notifying you that you may access your accounts through online banking. If the information we have on file does not match what you provide on the enrollment form, it may delay your enrollment. For a full list of account offerings, please refer to our Personal Banking and Business Banking pages.

Need access to your accounts on-the-go? Download the TowneBank Mobile Banking app for both personal and business accounts in just minutes on the App Store, or via Google Play. -

Increasing ownership in TowneBank is easy with the TowneBank Member Stock Purchase and Dividend Reinvestment Plan.

To participate, please download, print and complete the following:

Submit completed forms to Computershare, TowneBank's transfer agent, at the following address:

Computershare Shareholder Services

Attn: DRP Department

P.O. Box 505000

Louisville, KY 40233

You may also contact Computershare at 1-800-368-5948.

For more information, visit our Stock Purchase/Dividend Reinvestment Plans Page.

banking in norfolk va

Have a Question?

We're here to help!